SJP Understanding risks

When making decisions on how and where to invest for your retirement, one of the most important questions to consider is about risk. How much is right for you?

Behavioural biases

Behavioural biases are the unconscious emotional triggers that can inform our views and decisions. Understanding how some of these work can be useful, particularly with investment choices as part of your retirement planning, in order to avoid making costly mistakes.

We all like to think we make rational decisions, but we’re all human. Here are a few common biases that many of us need to be aware of:

Framing:

This considers how some people may alter their decision making by using a narrow set of parameters. For instance, judging the performance of a single asset within a portfolio of investments, without bearing in mind its relevance to the rest of the portfolio. An example could be cash, which has experienced poor returns, but provides stability in times of volatility.

Loss aversion:

This describes how investors can be more sensitive to loss than favouring an equivalent gain. It goes some way to explaining why some people delay selling a poorly performing investment for too long, simply for fear of realising the loss.

Herding:

This describes buying into a market or product simply because everyone else is, without seeing if it’s the right thing for you. It’s the fear of missing out.

The key to making better decisions, and avoiding potential pitfalls, is to take emotion out of the equation.

This is why speaking to your St. James’s Place Partner can be crucial, particularly when markets are volatile, or you are thinking of making changes to your investments.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

Longevity

One of the biggest risks that everyone faces, especially with retirement planning, is underestimating how long we will live for. We are, on average, living longer than ever before, which means that we need to plan for longer retirements.

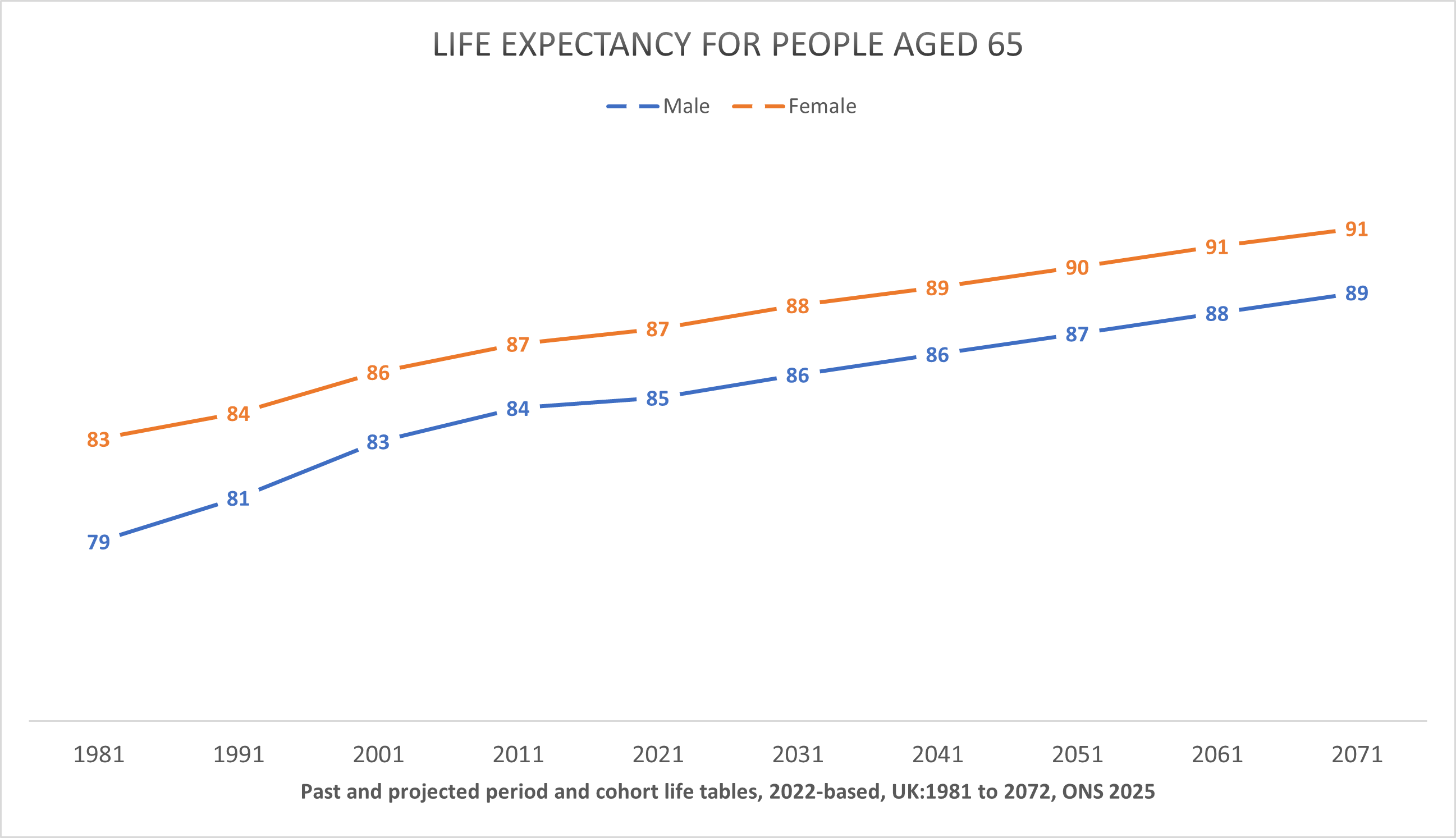

The graph shows just how much life expectancy has changed already in recent years, and what the projections from the ONS indicate for the future. For instance, a female aged 65 in 1981 had a life expectancy of 83, however by 2071, a 65 year old woman is expected to live to 91. This highlights the fact that we all need to start planning to be retired for a longer time compared to previous generations. The 30 year retirement is fast becoming the ‘new normal’.

Source: Office for national statistics, 2025

Inflation

Inflation is an ever-present part of financial life, and must be factored into your financial objectives for your retirement. Put simply, inflation causes the erosion of the purchasing power of your money over time.

This is an important risk to be aware of, as your retirement savings and contributions will need to increase by at least the rate of inflation to retain the value of your money in the future.

Although we can’t predict the future, looking at how costs have changed in the past can help demonstrate the risk of inflation. Using the Bank of England inflation calculator, goods that cost £1,000 in Jan 2014, would cost £1,356 in Feb 2025. This helps to show how prices can change over time. If you would like to inflation proof your retirement savings, find out how with your St. James’s Place Partner.

Volatility

Short term market fluctuations are a natural part of investing into equity markets.

The ups and downs of the global stock markets are affected by many economic, political and regulatory situations. Long term investment in equities, bonds and commercial property has historically proved to be the best way to grow capital, although there is no guarantee that this will prove to be the case in the future.

Maintaining a long term investment view, particularly when saving for retirement, can be a challenge when faced with short term volatility.

It can be tempting to make hasty changes, but It’s almost impossible to accurately time the falls and rises in the stock markets as an investor. The danger of trying to avoid the falls could mean that you also miss out on the rises. This can have quite an impact on your investments over the longer term.

The idea to remember is that longer term investing is all about your time in the market, rather than timing the market.

Making the most of your hard earned savings and growing your retirement wealth means taking sound financial advice, and sometimes accepting that doing nothing during volatile markets can also be the right thing to do.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Please note that past performance is not indicative of future performance.

Let us help you find a local adviser

Find a local adviser

Let us help you find your local financial adviser

Find your local financial adviser