- News

What is happening with US politics? What will the volatility mean for my investments and US holdings? In my recent months travelling around – from Singapore to Dubai, Edinburgh and Manchester – these have been the questions on almost every investor’s lips.

And it’s not surprising really. Or unexpected. The geopolitical picture appears to change daily, much of it driven by decisions made by President Trump. Many of which he later retracts or reverses. Markets have moved up and down as announcements and then concessions are made. The breakout of the recent Iran conflict saw markets move less but they still reacted. This can all be unnerving for investors to say the least.

In my last CIO note I wrote about market turbulence and the importance of portfolio resilience. As markets fluctuate, the noise surrounding volatility can be deafening. But it is the wrong thing to focus on.

Earlier this year, I also looked at how, in uncertain environments, ‘fat tails’ – a term for extreme outcomes – become more likely. To put it another way, events can suddenly take a sharp turn and destabilise even experienced investors. Unfortunately, this is what we are currently witnessing in many areas.

Red caps: Rising uncertainty and politics

Trump is nothing if not a populist. And behind many of his decisions lie the sentiment ‘Make America Great Again’. These are the words you see on many red baseball caps at Trump rallies and in media coverage, and which resonate with millions of US voters.

Take the tariffs, which have swung from one direction to another and back again. The aim of these is ostensibly to reduce any trade deficits between US and other countries. The thinking being US companies have been at a disadvantage compared to their counterparts in other part of the world, because of tariffs they face exporting goods and services. By imposing tariffs on foreign-produced imports to the US, it will make US-produced goods more attractive to US consumers – so the argument goes.

Yet while tariffs may temporarily reduce trade deficits, they also cause potential economic harm. While we don’t have unfettered confidence in anyone’s ability to make economic forecasts, The International Monetary Fund has estimated Trump’s tariffs could reduce global economic growth by 0.5% next year. Meanwhile, in the short-term, the tariffs could push up costs for US consumers too, causing inflation to rise.

With Trump’s 90-day pause on reciprocal tariffs due to end imminently (July 9th), it looks highly likely that more volatility lies ahead. While the UK has secured some deals, it remains to be seen whether Europe will reach a beneficial trade deal with the US. All is still to play for where China is concerned too.

Meanwhile tensions remain high in the Middle East, despite a fragile ceasefire between Israel and Iran (at the time of writing). The Russian president has also taken advantage of the geopolitical focus being elsewhere to intensify attacks on Ukraine, with that war still very much ongoing.

Despite this gloomy backdrop, the latest US consumer sentiment figures show people are feeling slightly more positive about the economy. According to the University of Michigan’s consumer sentiment index published in June, Americans’ view of the economy has improved for the first time in six months.

Yet that is in the US. For the rest of the world, US policy is still raising questions – and uncertainty – for investors, as I see all too clearly when meeting with clients. What’s next? That’s the hard part. What will lead the markets up – or down – amid such unpredictability? And where does that leave us as investors?

US equities

Back to basics and to put it bluntly, it’s hard to argue US equities – as a proposition – are not riskier today than they were historically. Why? It’s actually not down to the news surrounding Trump’s policies. Instead, it is a combination of the concentration issue and the expensive valuations of many US companies.

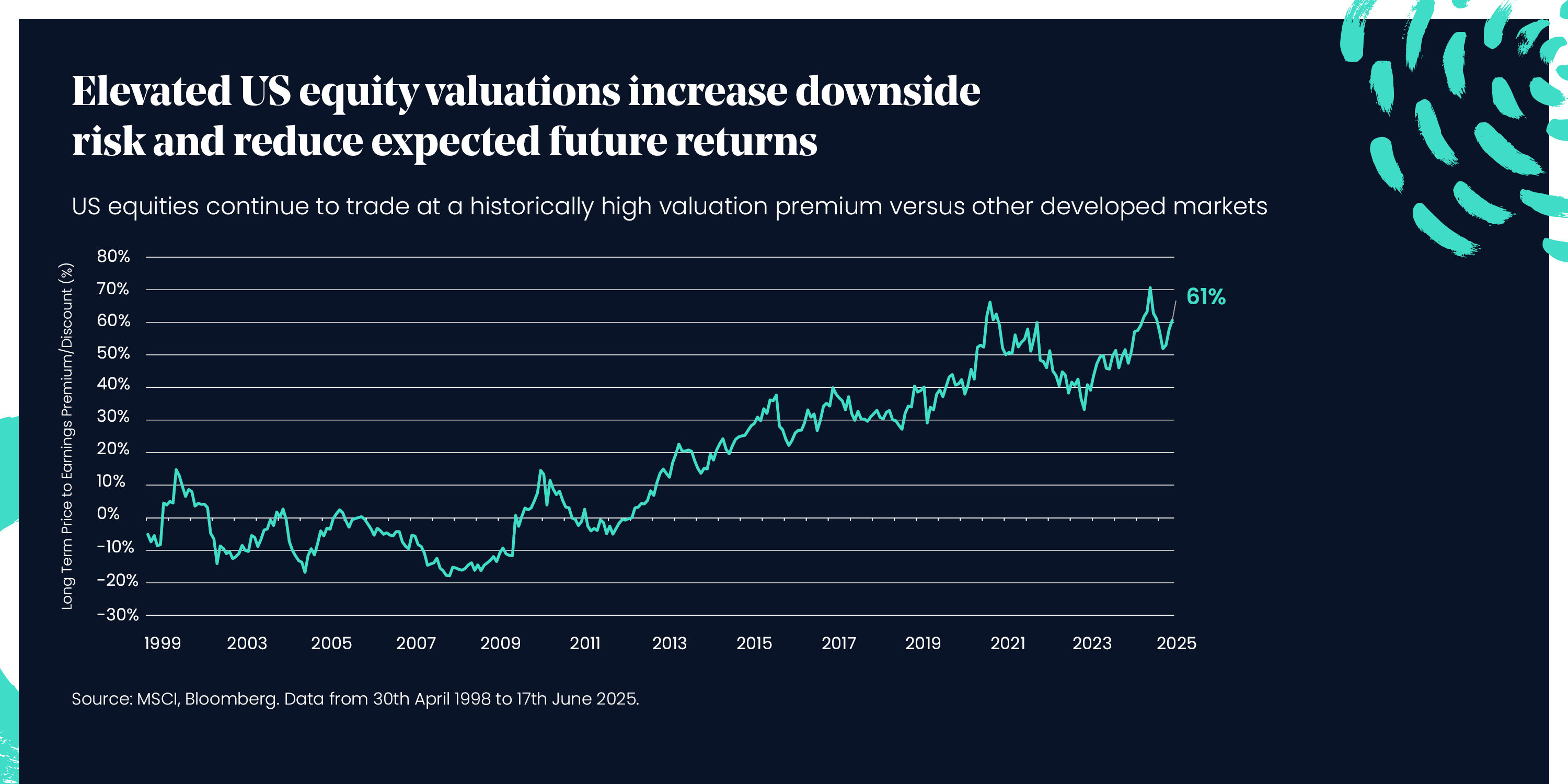

Price traps

The higher valuations of US companies – to levels close to those seen in the halcyon days of the dotcom boom in the late 1990s – make investing new money in the region unattractive. The higher valuations also reduce expected future returns. This is because investors are effectively paying a premium for future earnings growth. And if earnings don’t grow at a similar or even faster rate than they have, the share price can be more vulnerable to sharp swings. In other words, the so-called safety margin for investors is reduced when companies are highly valued.

Past performance is not a reliable indicator of future performance.

Past performance is not a reliable indicator of future performance.

Please note it is not possible to invest directly into the MSCI US index and the figures shown do not take into account any charges applicable to the appropriate investment wrapper or any relevant tax charges.

The concentration conundrum

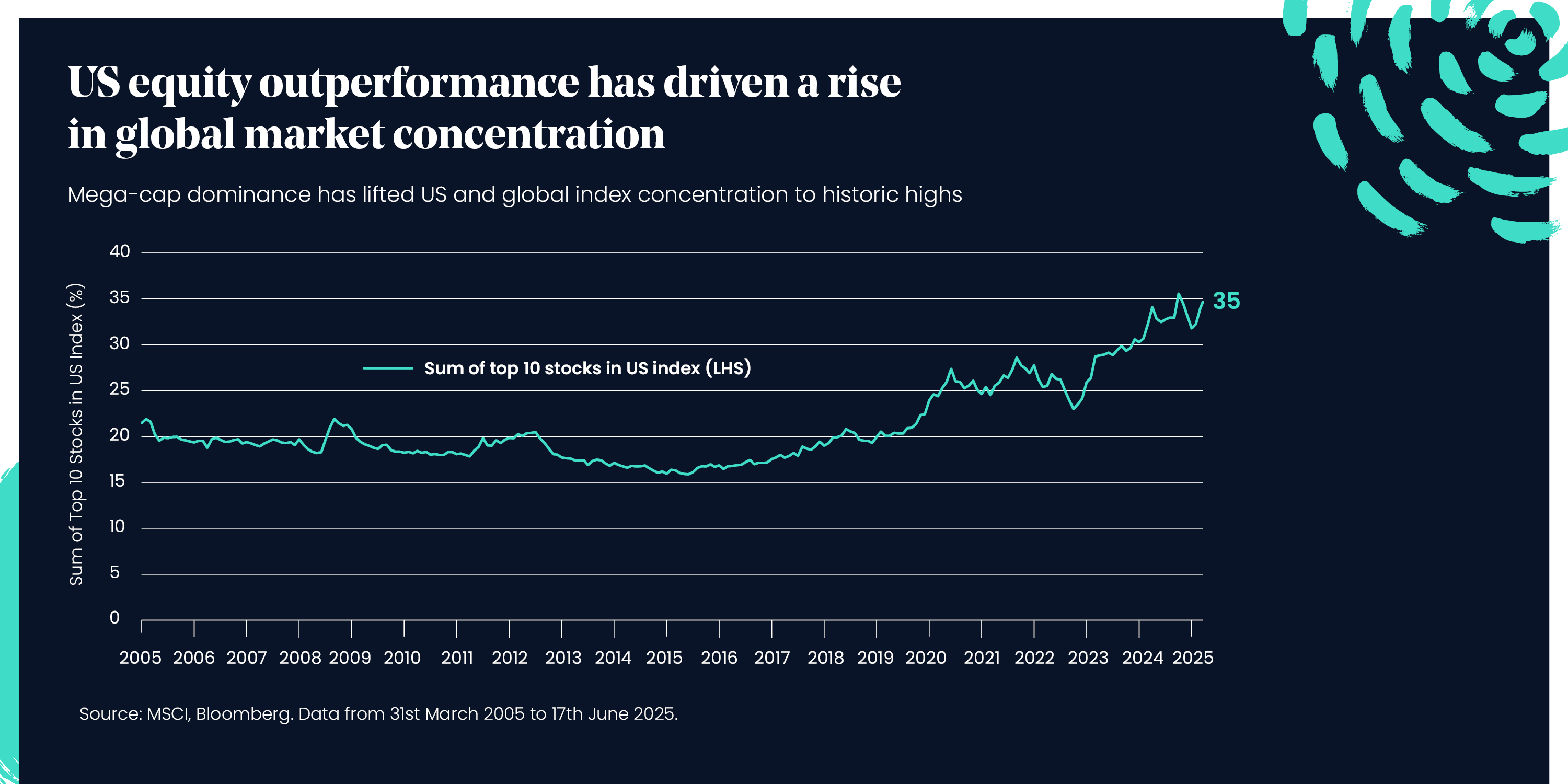

The US concentration conundrum is glaring: around two-thirds of global equities now sit in the US. This is up significantly over the last decade or so.

Yet it doesn’t stop there. Over the past decade US equities have substantially outperformed their international counterparts. These returns have been driven by a handful of extraordinarily large US companies, in particular the so-called “Magnificent 7” stocks (Apple, Amazon, Alphabet, Meta, Nvidia and Tesla). The top 10 stocks in the US make up over a third of the market, marking the highest concentration in six decades.

Past performance is not a reliable indicator of future performance.

Past performance is not a reliable indicator of future performance.

Please note it is not possible to invest directly into the MSCI US index and the figures shown do not take into account any charges applicable to the appropriate investment wrapper or any relevant tax charges.

And…it doesn’t even stop there. The technology concentration in the index is also now approaching “dot com” boom levels of the late 1990s despite reclassification of several names in the index (i.e. companies such as Amazon being moved from Technology to Consumer Discretionary).

Given this concentration, I would make the point this is not about returns for investors – it’s about managing overall risk. It is extremely difficult to argue the risk of US equities is not greater today than it was 10-15 years ago. If an investor’s appetite to risk has not changed, then it is hard to argue that they should be holding more of a concentrated market at higher valuations. To be clear, this is not us trying to call the top of the market. Instead, it is us stressing that for a medium-term investor, on the balance of probabilities, the outlook for US equities versus the rest of the world appears challenged.

It can be hard when looking at the data to think that the dominance of the US market won’t continue. And yet, if history shows us anything it’s that past performance is no prediction of future outcomes. This is borne out time and again.

As the below charts show, in the first 10 years of the 21st century emerging markets were the soaraway growth story. US equities were largely flat over the same period. However, between 2010 and 2023 US equities far outperformed emerging markets and also UK equities. And who knows what will happen in the coming years, particularly given the extremely volatile geopolitical environment and the economic pressures the US is facing.

Past performance is not a reliable indicator of future performance.

Please note it is not possible to invest directly into the MSCI US, UK and EM indices, and the figures shown do not take into account any charges applicable to the appropriate investment wrapper or any relevant tax charges.

Our position

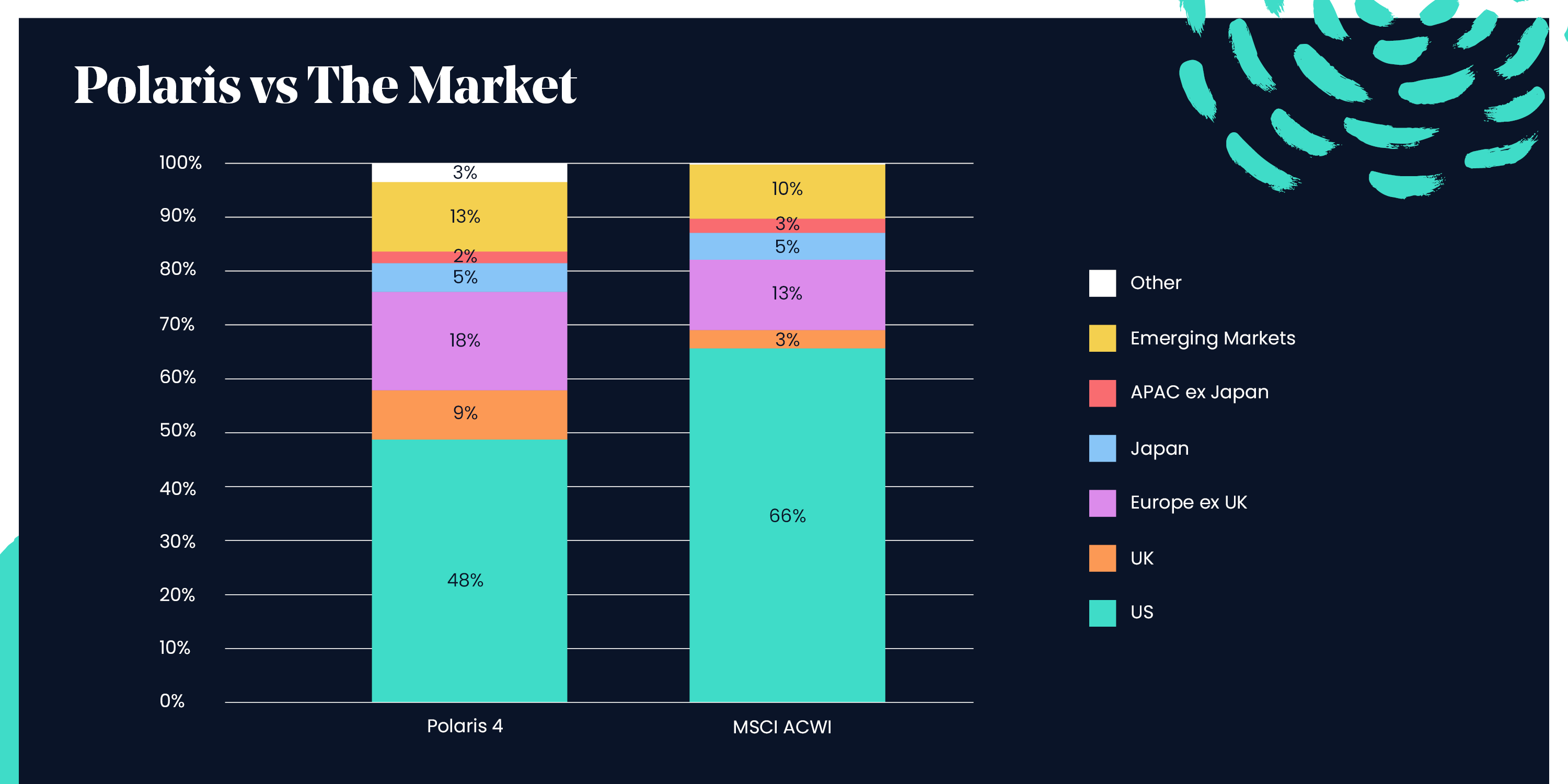

While we are leaning away from the US right now, we still invest significantly in the world’s largest market. Indeed, it remains the largest equity position we have across our portfolios. The US makes up so much of the world market, the risk of not having significant exposure weighs higher than the risks we think it poses to future returns. We need to strike a balance. As such we allocate less to the region versus its share in global markets. Heading into the third quarter, our asset allocation stance shows us being significantly underweight the country (15% below market weight for Polaris 4).

To conclude

Data shows that being out of the US market in recent years could cost investors dear. Yet it is about taking a considered approach and thinking long term. It is worth pointing out that despite all the noise, the link between politics and equity markets is actually quite vague. Politics may move the markets temporarily, but over the mid to long term it’s a different story.

What really matters is valuations over the median term. You can’t just use valuations blindly – something may have a high value but that doesn’t necessarily make it a good investment. We believe as investors you have to think of moderators. These are the fundamentals, sentiment, tail risks and economics. That’s why valuations are at the heart of our process and will continue to be, however volatile the economic climate. Or US politics.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The information contained above, does not constitute investment advice. It is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Full advice should be taken to evaluate risks, consequences and suitability of any prospective fund or investment.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Most recent articles